TABLE { BORDER-RIGHT: medium none; PADDING-RIGHT: 0px; BORDER-TOP: medium none; PADDING-LEFT: 0px; PADDING-BOTTOM: 0px; MARGIN: 0px; BORDER-LEFT: medium none; PADDING-TOP: 0px;CSS:

BORDER-BOTTOM: medium none}TD { BORDER-RIGHT: medium none; PADDING-RIGHT: 0px; BORDER-TOP: medium none; PADDING-LEFT: 0px; PADDING-BOTTOM: 0px; MARGIN: 0px; BORDER-LEFT: medium none; PADDING-TOP: 0px;BORDER-BOTTOM: medium none}IMG { BORDER-RIGHT: medium none; PADDING-RIGHT: 0px; BORDER-TOP: medium none; PADDING-LEFT: 0px; PADDING-BOTTOM: 0px; MARGIN: 0px; BORDER-LEFT: medium none; PADDING-TOP: 0px;BORDER-BOTTOM: medium none}FORM { BORDER-RIGHT: medium none; PADDING-RIGHT: 0px; BORDER-TOP: medium none; PADDING-LEFT: 0px; PADDING-BOTTOM: 0px; MARGIN: 0px; BORDER-LEFT: medium none; PADDING-TOP: 0px;BORDER-BOTTOM: medium none}TD { FONT-SIZE: 12px}P { FONT-SIZE: 12px}LI { FONT-SIZE: 12px}SELECT { FONT-SIZE: 12px}INPUT { FONT-SIZE: 12px}TEXTAREA { FONT-SIZE: 12px}SELECT { BORDER-RIGHT: #49b8e3 1px solid; BORDER-TOP: #49b8e3 1px solid; BORDER-LEFT: #49b8e3 1px solid; BORDER-BOTTOM: #49b8e3 1px solid; BACKGROUND-COLOR: #e2f4ff}INPUT { BORDER-RIGHT: #49b8e3 1px solid; BORDER-TOP: #49b8e3 1px solid; BORDER-LEFT: #49b8e3 1px solid; BORDER-BOTTOM: #49b8e3 1px solid; BACKGROUND-COLOR: #e2f4ff}TEXTAREA { BORDER-RIGHT: #49b8e3 1px solid; BORDER-TOP: #49b8e3 1px solid; BORDER-LEFT: #49b8e3 1px solid; BORDER-BOTTOM: #49b8e3 1px solid; BACKGROUND-COLOR: #e2f4ff}.f14 { FONT-SIZE: 14px}.lh19 { LINE-HEIGHT: 19px}A:hover { COLOR: #ff0000}.b1 { BORDER-RIGHT: #000000 1px solid; BORDER-TOP: #000000 1px solid; BORDER-LEFT: #000000 1px solid; BORDER-BOTTOM: #000000 1px solid}.b2 { BORDER-BOTTOM: #ffffff 1px solid}.b3 { BORDER-RIGHT: #cfe9f8 5px solid; BORDER-TOP: #cfe9f8 5px solid; BORDER-LEFT: #cfe9f8 5px solid; BORDER-BOTTOM: #cfe9f8 5px solid}.cRed { COLOR: #cc0000}.cGary { COLOR: #6c6c6c}.cBlue { COLOR: #066cd2}.linkBlankUl A:link { COLOR: #000; TEXT-DECORATION: underline}.linkBlankUl A:visited { COLOR: #000; TEXT-DECORATION: underline}.linkBlankUl A:active { COLOR: #f00; TEXT-DECORATION: underline}.linkBlankUl A:hover { COLOR: #f00; TEXT-DECORATION: underline}.linkBlank A:link { COLOR: #000; TEXT-DECORATION: none}.linkBlank A:visited { COLOR: #000; TEXT-DECORATION: none}.linkBlank A:active { COLOR: #f00; TEXT-DECORATION: none}.linkBlank A:hover { COLOR: #f00; TEXT-DECORATION: none}.linkRed { COLOR: #7b0000}.linkRed A:link { COLOR: #7b0000; text-: none}.linkRed A:visited { COLOR: #7b0000; text-: none}.linkRed A:active { COLOR: #7b0000; text-: underline}.linkRed A:hover { COLOR: #7b0000; text-: underline}.linkBlue A:link { COLOR: #003399; TEXT-DECORATION: underline}.linkBlue A:visited { COLOR: #003399; TEXT-DECORATION: underline}.linkBlue A:active { COLOR: #0268ce; TEXT-DECORATION: underline}.linkBlue A:hover { COLOR: #0268ce; TEXT-DECORATION: underline}HTML:

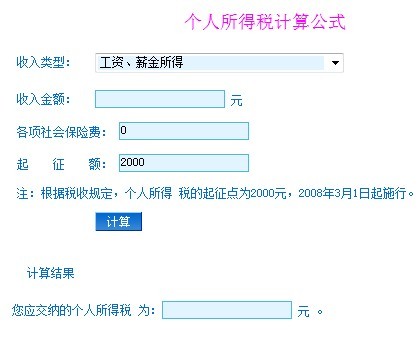

</STYLE> <SCRIPT language=javascript> <!--function warnInvalid (theField, s){newAlert(s);theField.focus();theField.select();return false;} function isNumber(s)//字符串是否由数字构成{var digits = "0123456789";var i = 0;var sLength = s.length; while ((i < sLength)){var c = s.charAt(i);if (digits.indexOf(c) == -1) return false;i++;} return true;} function CheckNumeric(theField,s) //整数或小数{var ret = true;var i;var str=theField.value;var Temp = new Number(str); if (str.length == 0){return warnInvalid (theField, s);ret=false;} if (ret){if (Temp.valueOf() != Temp.valueOf ()){return warnInvalid (theField, s);}} return ret;}function validateFormInfo(form){var strvar SumTovar srSumvar qzSum,InsuSum,TSum,yzSum,fySum s=document.form1.select.selectedIndex+1;srSum=document.form1.textfield.value;if (s.length<1){ s=1;}qzSum=document.form1.textfield3.value;InsuSum=document.form1.textfield2.value;yzSum=document.form1.textfield22.value;fySum=document.form1.textfield32.value;TSum=srSum-qzSum-InsuSum;/*newAlert_Top("sr="+srSum+"qz="+qzSum+"INsu="+InsuSum+"yz="+yzSum+"fy="+ fySum);*/ if (form == null) return true; str = "请正确输入收入金额!";if (!CheckNumeric(form.elements ["textfield"],str)) return false; //收入金额 if (document.all.select.selectedIndex==0){ str = "请正确输入社会保险费!"; if (!CheckNumeric(form.elements ["textfield2"],str)) return false; //各项社会保险费str = "请正确输入起征额!"; if (!CheckNumeric(form.elements ["textfield3"],str)) return false; //起征额} if (document.all.select.selectedIndex==8){ str = "请正确输入财产原值!"; if (!CheckNumeric(form.elements ["textfield22"],str)) return false; //各项社会保险费str = "请正确输入合理交易费用!"; if (!CheckNumeric(form.elements ["textfield32"],str)) return false; //起征额} switch (s){case 1:document.form1.textfield4.value=Rate1(TSum);break; case 2:document.form1.textfield4.value=Rate2(srSum);break; case 3:document.form1.textfield4.value=Rate2(srSum);break; case 4:document.form1.textfield4.value=Rate3(srSum);break; case 5:document.form1.textfield4.value=R4568(srSum)*70/100;break; case 6:document.form1.textfield4.value=R4568(srSum);break; case 7:document.form1.textfield4.value=srSum*20/100;break; case 8:document.form1.textfield4.value=R4568(srSum);break; case 9:if (srSum-yzSum-fySum<0){ newAlert_Top("都亏了!不用交税了!"); document.form1.textfield4.value=0;}if (srSum-yzSum-fySum>0){document.form1.textfield4.value= (srSum-yzSum-fySum)*20/100;}break; case 10:document.form1.textfield4.value=srSum*20/100;break; case 11:document.form1.textfield4.value=srSum*20/100;break; } }//--------------------------------以下是算法-------------- //---------------------------------------function Rate1(XSum)//工资薪金{var Rate;var Balan;var TSum;if (XSum<=500) {Rate=5; Balan=0; }if ((500<XSum) && (XSum<=2000)) {Rate=10; Balan=25; }if ((2000<XSum) && (XSum<=5000)) {Rate=15; Balan=125; }if ((5000<XSum) && (XSum<=20000)) {Rate=20; Balan=375; }if ((20000<XSum) && (XSum<=40000)) {Rate=25; Balan=1375; }if ((40000<XSum) && (XSum<=60000)) {Rate=30; Balan=3375; }if ((60000<XSum) && (XSum<=80000)) {Rate=35; Balan=6375; }if ((80000<XSum) && (XSum<=100000)) {Rate=40; Balan=10375; }if (XSum>100000) {Rate=45; Balan=15375; } TSum=(XSum*Rate)/100-Balan if (TSum<0) {TSum=0 } return TSum} function Rate2(XSum){var Rate;var Balan;var TSum;if (XSum<=5000) {Rate=5; Balan=0; }if ((5000<XSum) && (XSum<=10000)) {Rate=10; Balan=250; }if ((10000<XSum) && (XSum<=30000)) {Rate=20; Balan=1250; }if ((30000<XSum) && (XSum<=50000)) {Rate=30; Balan=4250; }if (50000<XSum) {Rate=35; Balan=6750; } TSum=(XSum*Rate)/100-Balan; if (TSum<0) {TSum=0 } return TSum} function R4568(XSum) { var TSumif (XSum<=4000){TSum=(XSum-2000)*20/100;}if (XSum>4000){TSum=(XSum-(XSum*20/100))*20/100}if (TSum<0){TSum=0}return TSum } function gong() { var qznum var ff qznum=document.form1.textfield3.value; ff=document.all.checkbox.checked; if (ff) { document.form1.textfield3.value=4000; } if (!ff) { document.form1.textfield3.value=2000; } } function Rate3(XSum)/*劳务报酬*/{ var TSum var Rate var Balan if (XSum<=20000) {Rate=20;Balan=0; } if ((XSum>20000) && (XSum<=50000)) {Rate=30;Balan=2000; } if (XSum>50000) {Rate=40;Balan=7000; } if (XSum<=4000) {XSum=XSum-800; } if (XSum>4000) {XSum=XSum-(XSum*20/100); } TSum=XSum*Rate/100-Balan; if (TSum<0) {TSum=0 } return TSum} function CHan(){ if (document.form1.select.selectedIndex==0) {document.all.gongzi.style.display="block";document.all.fei.style.display="block"; } if (document.form1.select.selectedIndex!=0) {document.all.gongzi.style.display="none";document.all.fei.style.display="none"; } if (document.form1.select.selectedIndex+1!=9) {document.all.fei1.style.display="none"; } if (document.form1.select.selectedIndex+1==9) {document.all.fei1.style.display="block"; }}//--> </SCRIPT> <script type="text/javascript">var item=new Array(new Array("银行类工具(存款)",//<-- 大类名,下面几行则为此类下的所有计算器new Array(new Array("通知存款计算器","http://finance.sina.com.cn/283/2005/0704/2.html"),//<-- 此2项分别为“计算器名”,“链接”new Array("整存零取计算器","http://finance.sina.com.cn/283/2005/0711/24.html"),new Array("最佳存款组合","http://finance.sina.com.cn/283/2005/0711/30.html"),new Array("整(零)存整取计算器","http://finance.sina.com.cn/283/2005/0711/29.html"),new Array("活期储蓄计算器","http://finance.sina.com.cn/283/2005/0711/28.html") //<-- 依次向下罗列,最后一行“)”后没有“,”)), //<-- 非结尾大类后有“,” new Array("银行类工具(贷款)",//<-- 另一个大类new Array(new Array("等额本息还款计算器","http://finance.sina.com.cn/283/2005/0704/3.html"),new Array("等额本金还款计算器","http://finance.sina.com.cn/283/2005/0704/1.html"),new Array("提前还贷计算器","http://finance.sina.com.cn/283/2005/0708/18.html"),new Array("公积金贷款额度年限计算器","http://finance.sina.com.cn/283/2005/0704/6.html")//<-- 最后一行“)”后没有“,”)), //<-- 非结尾大类后有“,” new Array("保险类工具",//<-- 另一个大类new Array(new Array("基本养老保险计算器","http://finance.sina.com.cn/283/2005/0704/10.html"),new Array("基本医疗保险计算器","http://finance.sina.com.cn/283/2005/0708/11.html"),new Array("工伤保险计算器","http://finance.sina.com.cn/283/2005/0704/5.html"),new Array("失业保险","http://finance.sina.com.cn/283/2005/0708/16.html"),new Array("住房公积金计算器","http://finance.sina.com.cn/283/2005/0711/23.html"),new Array("退休时每月领取的养老保险金估算计算器","http://finance.sina.com.cn/283/2005/0708/20.html"))), new Array("股票类工具",//<-- 另一个大类new Array(new Array("股票收益计算器 ","http://finance.sina.com.cn/283/2005/0704/8.html") )), new Array("基金类工具",//<-- 另一个大类new Array(new Array("基金买卖计算器","http://finance.sina.com.cn/283/2005/0708/12.html"))), new Array("期货类工具",//<-- 另一个大类new Array(new Array("期货理财计算器 ","http://finance.sina.com.cn/283/2005/0708/14.html"))), new Array("债券类工具",//<-- 另一个大类new Array(new Array("债券收益率计算器","http://finance.sina.com.cn/283/2005/0711/25.html"))), new Array("外汇",//<-- 另一个大类new Array(new Array("外汇储蓄计算器","http://finance.sina.com.cn/283/2005/0711/27.html"),new Array("外汇兑换计算器","http://finance.sina.com.cn/283/2005/0711/26.html"))), new Array("税务类",//<-- 另一个大类new Array(new Array("买房税费计算器","http://finance.sina.com.cn/283/2005/0708/17.html"),new Array("个人所得税计算器","http://finance.sina.com.cn/283/2005/0704/4.html") )), new Array("理财规划类",//<-- 另一个大类new Array(new Array("理财规划计算器","http://finance.sina.com.cn/283/2005/0708/13.html"),new Array("子女教育基金计算器","http://finance.sina.com.cn/283/2005/0711/21.html"),new Array("投资收益计算器","http://finance.sina.com.cn/283/2005/0708/19.html"),new Array("资产净值计算器","http://finance.sina.com.cn/283/2005/0711/22.html"),new Array("黄金理财计算器","http://finance.sina.com.cn/283/2005/0704/9.html"))),new Array("买车计算",//<-- 另一个大类new Array(new Array("购车综合计算器","http://finance.sina.com.cn/283/2005/0708/15.html"))), new Array("购房计算",//<-- 另一个大类new Array(new Array("购房能力评估计算器","http://finance.sina.com.cn/283/2005/0704/7.html"),new Array("提前还贷计算器","http://finance.sina.com.cn/283/2005/0708/18.html"),new Array("税费计算器","http://finance.sina.com.cn/283/2005/0708/17.html"),new Array("公基金贷款额度年限计算器","http://finance.sina.com.cn/283/2005/0704/6.html"),new Array("等额本金还款法计算器","http://finance.sina.com.cn/283/2005/0704/1.html"),new Array("等额本息还款法计算器","http://finance.sina.com.cn/283/2005/0704/3.html") ))); //-------------- var img0 =new Image();img0.src="http://image2.sina.com.cn/cj/toolsjs/cj_jsq_lj_010.gif";var img1 =new Image();img1.src="http://image2.sina.com.cn/cj/tools4.gif"; function ShowItem (itemId){for (var i = 0; i < item.length; i++) {eval("document.images["tImg" +i+ ""].src ="http://image2.sina.com.cn/cj/toolsjs/cj_jsq_lj_010.gif"");eval("document.all.item" + i +".style.display = "none"");eval("document.all.menu" + i +".style.background= "#1e86b0"");eval("document.all.menu" + i +".style.color= "#ffffff""); }eval("document.images["tImg" +itemId + ""].src ="http://image2.sina.com.cn/cj/toolsjs/cj_jsq_lj_011.gif"");eval("document.all.item" + itemId +".style.display = "block"");eval("document.all.menu" + itemId +".style.background= "#0268CE"");eval("document.all.menu" +itemId+".style.color= "#ffffff"");} </script> <META content="MSHTML 6.00.6000.16640" name=GENERATOR></HEAD><BODY bgColor=#ffffff topMargin=5 marginheight="5"><CENTER><TABLE cellSpacing=0 width=500> <FORM name=form1> <TBODY> <TR><TD height=1></TD></TR> <TR><TD> <TABLE style="MARGIN-LEFT: 48px" cellSpacing=0 width=476 align=center><TBODY><TR> <TD class=cBlue style="padding-: 7px" vAlign=bottom align=middle height=39><FONT color=#ff00ff size=4> 个人所得税计算公式</FONT></TD></TR><TR> <TD background="/OA/images/cj_jsq_lj_006.gif"height=1></TD></TR></TBODY></TABLE> <TABLE class=cBlue style="MARGIN: 18px 0px 10px 38px" cellSpacing=0><TBODY><TR> <TD style="padding-: 2px">收入类型:</TD> <TD><SELECT id=select onchange=CHan() name=select> <OPTION value=1 selected>工资、薪金所得<OPTION value=2>个体工商户生产、经营所得<OPTION value=3>对企事业单位的承包经营、承 租经营所得<OPTION value=4>劳务报酬所得<OPTION value=5>稿酬所得<OPTION value=6>特许权使用所得<OPTION value=7>利息、股息、红利所得<OPTION value=8>财产租赁所得<OPTION value=9>财产转让所得<OPTION value=10>偶然所得(如:中奖、中彩)<OPTION value=11>被确定征税的其他部分</OPTION></SELECT></TD></TR><TR> <TD height=5></TD></TR><TR> <TD></TD> <TD><TABLE id=gongzi style="DISPLAY: block" cellSpacing=0 width="100%"><TBODY> <TR><TD><!--<INPUT name=checkbox onclick=gong() type=checkbox value=checkbox>外籍人员及境外 工作的中国公民--></TD></TR></TBODY></TABLE></TD></TR><TR> <TD height=10></TD></TR><TR> <TD class=cBlue style="PADDING-TOP: 2px" width=60>收入金额:</TD> <TD><INPUT id=textfield name=textfield> 元 </TD></TR><TR> <TD height=12></TD></TR><TR> <TD colSpan=2><TABLE class=cblue id=fei style="DISPLAY: block" cellSpacing=0cellPadding=0 width="100%" border=0> <TBODY> <TR><TD>各项社会保险费: <INPUT id=textfield2 value=0 name=textfield2><BR></TD></TR> <TR><TD height=12></TD></TR> <TR><TD>起 征 额: <INPUT id=textfield3 value=2000name=textfield3></TD></TR> <TR><TD><br />注:根据税收规定,个人所得 税的起征点为2000元,2008年3月1日起施行。</TD></TR></TBODY></TABLE></TD></TR><TR> <TD colSpan=2><TABLE class=cblue id=fei1 style="DISPLAY: none; MARGIN-LEFT: 43px"cellSpacing=0 cellPadding=0 width="100%" border=0> <TBODY> <TR><TD align=right width=100>财产原值:</TD><TD><INPUT id=textfield22 value=0 name=textfield22></TD></TR> <TR><TD height=5></TD></TR> <TR><TD align=right width=100>合理交易费用:</TD><TD><INPUT id=textfield33 value=0 name=textfield32></TD></TR></TBODY></TABLE></TD></TR><TR> <TD height=10></TD></TR><TR> <TD></TD> <TD><INPUT style="BORDER-RIGHT: 0px; BORDER-TOP: 0px; BACKGROUND-IMAGE: url(http://image2.sina.com.cn/cj/toolsjs/cj_jsq_lj_015.gif); BORDER-LEFT: 0px; WIDTH: 47px;CURSOR: pointer; BORDER-BOTTOM: 0px; HEIGHT: 19px" onclick=validateFormInfo(this.form,1) type=button name=button> </TD></TR></TBODY></TABLE></TD></TR> <TR> <TD height=1></TD></TR> <TR> <TD> <TABLE style="MARGIN-LEFT: 48px" cellSpacing=0 width=476> <TBODY> <TR> <TD class=cBlue style="padding-: 7px" vAlign=bottom height=39>计算结果 </TD></TR> <TR> <TD background="/OA/images/cj_jsq_lj_006.gif" height=1></TD></TR></TBODY></TABLE> <TABLE class=cBlue style="MARGIN: 18px 0px 27px 13px" cellSpacing=0> <TBODY> <TR> <TD class=cBlue style="PADDING-TOP: 2px" align=right width=170>您应交纳的个人所得税 为:</TD> <TD><INPUT id=textfield4 name=textfield4> 元 。</TD></TR></TBODY></TABLE></TD></TR></TBODY></FORM></TABLE></CENTER></BODY></HTML>以上所述就是本文的全部内容了,希望大家能够喜欢。